Our Products

Hire purchase

The Company is practicing hire purchasing that allowed to transfer full ownership to the enterprise (lessee) at the end of the lease period. Due, the MSMEs are interested in this type of products to be leased. Also hire purchase is very tailored for MSMEs because it is a type of leasing of capital goods finance by which a lesser provides a lessee with the use of specified capital goods, against payment of mutually agreed installments over a specified period of time, with each lease payment, an equal percentage of the owner ship is transferred to the lessee on the last payment, the ownership of capital goods transferred to the lessees.

Financial Lease

Financial lease is a type of commercial lease in which a finance company is the legal owner of an asset, and the user rents the asset for an agreed-upon period of time. In this legal contract, the leasing company, usually the finance company is the owner and the lessees are the user of the asset.

We are offering on the following sectors

- Garments

- Wood & Metal Products

- Food & agro-processing

- Textile & knitting

- Leather & Leather products

- Printing & paper products

- Chemicals and chemical products

- Rubber and plastic products

- Mining and quarrying

Manufacturing

- Construction material production (Stone Crusher, Block and related Production)

- Ceramics and related production

- Compacting and related Services

- Excavation and Building

- And, Other related Services

Construction and input productions

- Farming

- Crop production and Harvesting

- Other related Services

Agriculture Mechanization

- Medical service

- Tour & Tourism

- Other service sectors

Service

Eligibilities and Requirements to get our services

Requirements or eligible criteria to get a lease Finance from our company are:-

- Fully aware of the lease services of the leasing company/well know the service rendered by the company;

- Sufficient knowledge, skill and understanding of the machinery /equipment/ required by the MSMEs;

- The amount of lease capital /the total value of the asset/ required to be leased from Birr 25,000 to 10 million;

- Can provide/submit/ a Business Plan or Can submit a Project Proposal for projects worth over 5 million Birr;

- Ability to save up to 20 to 50 percent of the total value of the leased asset of the MSMEs ;

- Provide detail specifications for the machine to be purchased:

- The infrastructure is complete with adequate production and sales space;

- The MSMEs have to be submitted a renewed business license, registration certificate and Taxpayer Identification Number (TIN);

- Audited accounts of existing enterprises; otherwise are new, willing to investigate;

- Have a good credit history from other lending financial institutions;

- Those who have operating funds or can get a loan from the Financial institutions;

- Those who are willing to cover for travel and fire insurance and are willing to renew their machines/equipment/ agreement annually;

- Those who are willing to register the contracts and also the machines/equipment;

- Willing to maintain the leased asset /machine/ properly and repairs the machine/asset/ in the event of a breakdown;

- Provide evidence of marital status (married / unmarried)

- Provide renewed residency ID from kebeles (sub-cities);

- The MSMEs, who are interested in engaging in priority activities (sectors)

Our mission is to provide modern inclusive & efficient leasing service to Micro, Small & medium enterprises which contributes to the socio-economic transformation of the nation.

Who We are?

Waliya Capital Goods Finance Business s.c was established and licensed by National Bank of Ethiopia in February 19, 2014 as per proclamation No.103/1998 Capital Goods Leasing Business and as per proclamation No. 807/2013 to amend the Capital Goods Leasing Business. The company was started its operation with the paid up Capital of 400 million Ethiopian Birr (ETB) and it has 7 shareholders including Amhara credit & saving institution and the Amhara regional State Administration council.

The Company by virtue of its size is provided a level of service which enterprises may be unable to buy different machineries due to lack of money.Enterprises from different branches selected to have being delivered the company’s service through their business plan and expected to save or contribute 15 to 50 percent of the total cost of the capital goods which they needed to buy and being transferred.

Thereafter, beneficiary enterprises repay its outstanding loan including 15% administration coast for about 3 to 10 years according to the amount of loan.

Due, the company outreaches its service through 27 main branches of different towns including Addis Ababa, and 187 satellite offices. It was started by opening 11 branches with in the Amhara region since January, 2015. Till the end of June 2024, has delivered a number of 16,045 capital goods which are worth above 2.4 billion birr for about 5,263 enterprises, which are mainly employed in manufacturing , construction, Agriculture, tourism, and selected service sectors.Beacuse of the company's lease finance Service more than 33,000 Citizens have been employed.

Mission

To provide modern inclusive & efficient leasing service to Micro,

Small & medium enterprises which contributes to the socio-economic

transformation of the nation.

Vision

To be one of the Top Ethiopia leading leasing companies by 2035 G.C

Core Values

WCGFB S.C adheres to the following core values:

Excellence services:

The Company commits itself to the attainment of the highest standards in capital goods financing performance by delivering high-quality equipment, services and supports of enterprises and customers promoting excellence in research.

Innovation:

The Company promotes the development of innovative ideas that are marketable and that address economical needs.

Accountability and Transparency:

Reliable and regularly updated financial and results data are an essential component of informing, monitoring, reporting and evaluating progress towards achieving decent work for all our stakeholders. Therefore, The Company ensures financial and equipment assets management accountability and transparency through responsible decision making and prudent management of resources entrusted to it.

Integrity and honesty:

The Company fosters honesty, integrity, fairness and ethical and professional codes of conduct in its operation, research, and managing of its resources.

Customer focused:

The Company strives to provide high quality services and benefit to its customers effectively and efficiently.

Responsiveness:

The Company ensures that clients are served helpfully and responsibly by our managements and staffs. The first step we act according to responsiveness is to commit to interact cooperatively and respectfully with clients. When a client enters our office and facility and asks for help, the front-line service provider must listen to him and come to understand what need the client is expressing.

Teamwork:

The company is highly committed to bring collaborative effort of a group to achieve a common goal or to complete a task in the most effective and efficient way.

Professionalism:

Professionalism is excels in the knowledge, skills, and behaviors required by the employs role; delivers the work to the best of the abilities, even on tough days; goes above and beyond the job description; constantly looks for opportunities to grow and improve the company.

Sense of owner ship:

It is about taking initiative which means we believe that taking action is not someone else’s responsibility. We as a group or an individual are accountable for the quality and timeliness of an outcome, even when we’re working with others. It does mean we have an obligation to the results of the company and that we have an obligation to act on items that impact those results.

Motto

Customer satisfaction is our first best

Marketing Slogan:

Ethiopia’s choice for capital goods financing

Hire purchase products

From a product perspective, two types of products are licensed to lease in Ethiopia (i.e. Hire purchase & Financial lease). However, currently, the Company is practicing hire purchasing that allowed to transfer full ownership to the enterprise (lessee) at the end of the lease period. Due, the MSMEs are interested in this type of products to be leased. Also hire purchase is very tailored for MSMEs because it is a type of leasing of capital goods finance by which a lesser provides a lessee with the use of specified capital goods, against payment of mutually agreed installments over a specified period of time, with each lease payment, an equal percentage of the owner ship is transferred to the lessee on the last payment, the ownership of capital goods transferred to the lessees.

We are offering on the following sectors in hire purchase

- Garments

- Wood & Metal Products

- Food & agro-processing

- Textile & knitting

- Leather & Leather products

- Printing & paper products

- Chemicals and chemical products

- Rubber and plastic products

- Mining and quarrying

Manufacturing

- Construction material production (Stone Crusher, Block and related Production)

- Ceramics and related production

- Compacting and related Services

- Excavation and Building

- And, Other related Services

Construction and input productions

- Farming

- Crop production and Harvesting

- Other related Services

Agriculture Mechanization

- Medical service

- Tour & Tourism

- Other service sectors

Service

Financial Lease

Nothing in the law and directives prevents the company considering financial leases. However, many MSMEs are interested in hire purchase type of leasing rather than financial lease which the latter is a type of commercial lease in which a finance company is the legal owner of an asset, and the user rents the asset for an agreed-upon period of time. In this legal contract, the leasing company, usually the finance company is the owner and the lessees are the user of the asset.

We are offering on the following sectors in financial lease

- Garments

- Wood & Metal Products

- Food & agro-processing

- Textile & knitting

- Leather & Leather products

- Printing & paper products

- Chemicals and chemical products

- Rubber and plastic products

- Mining and quarrying

Manufacturing

- Construction material production (Stone Crusher, Block and related Production)

- Ceramics and related production

- Compacting and related Services

- Excavation and Building

- And, Other related Services

Construction and input productions

- Farming

- Crop production and Harvesting

- Other related Services

Agriculture Mechanization

- Medical service

- Tour & Tourism

- Other service sectors

Service

Training

Training is one of our services. Training services are provided by various entities that enable productive enterprises to lead their business with better knowledge and skills. In particular, the enterprises that are recruited to receive the services of the company will be given training on matters of great importance to business efficiency. On-the-job training is also available for existing customers, for example, there are many who have received training on business management skills from the World Bank and other cooperating institutions. Apart from this, they will be given professional support when they want to provide training to various bodies in the sector.

- Entrepreneurship

- Business feasibility study

- business plan preparation

- Basic accounting

- Machines’ usage and Maintenance

- Preparation of machineries specification

- Industry extension support

- Womens’ participation and benefit

- Benefits and importance of savings

- On the effective usage and conduct of loan

- Provision of operational loans

- The nature and benefits of capital goods finance services

- Arrangement of information to be provided by users of lease finance

- Crucial recruitment points and clear information on lease finance

- Loan disbursement rate and types of disbursement system

Our training services are mainly focused on the following areas

These trainings are provided in collaboration with TVET collages, labor and training offices, women's, youth and children's offices, and Tseday bank S.C, and the beneficiaries are customers who will benefit from lease financing. In addition, they will get training on the following subjects from Waliya capital goods finance business Share Company.

Apart from this, we would like to take this opportunity to inform that if any governmental and non-governmental national and international institutions working in the field has frameworks for training in these fields and wants to be given training, we can work together and provide support.

We're working hard to give you the best experience!

come and visit us !!!

No new news for now

summarized Reports

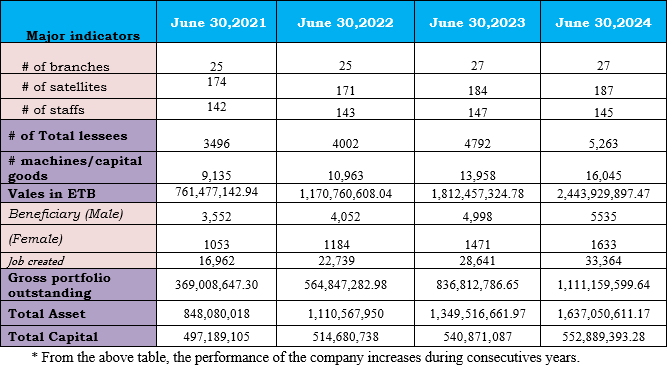

Waliya Capital Goods Finance Business Share Company was established by seven shareholders with paid-up capital of Birr 400,000,000.00 (Birr four hundred million) and now grown up to Birr 552.89 Million after the shareholders dividends added to Birr 465,893,000 (four hundred sixty five million eight hundred ninety three thousand). The two major shareholders are Amhara credit & saving institution /Tseday Bank/ and Amhara regional State Administration council holding 75% of the total share, with corresponding share of 50% and 25% respectively. The rest of the shareholders contribute 25% mainly are development organizations working in the region. Currently, the company has been providing Capital Goods finance services to 2,415 active lessees as of June 30, 2024 through its head offices which is 26 branches outlaying in different zones and towns of the region and one branch is located in Addis Ababa City.

Since establishment, the company has financed 16045 Capital Goods which have the values of Birr 2,443,929,897.47 for 5263 lessees having a total number of 7168 members out of which 5535 members are male and 1633 members are female within 26 branches and more than 187 satellite offices addressed in different towns of Amhara Region and one branch in Addis Ababa city. In addition, the company has created job opportunity for more than 33,364 job seekers

The company currently has an asset worth Birr 1.6 billion and a total capital of Birr 552.89 million. The company has covered the larger portion of the lease market in the region as well as in the country with respect to the five established leasing companies in the country.

To summarize, the company’s recent four years change and cumulative achievements, each year has significant increments, however, recently the internal conflict in the region and financial shortages have adversely affect the performance of the company.

Stratagic issues and Plans

Marketing plan

Even if Leasing in Ethiopia is found to be at infant stage, there is growing chance both in volume and quantity of capital goods provisions through aggressive advertising and face to face mentoring. Currently the company has potential customers in the regions as well as in the country level. The market is still not satisfied with the existing leasing companies in the country. The main customers of the company are small and medium enterprises involving in production activities in manufacturing, agro processing, agriculture and other service activities. These enterprises that are developing status or those who are expanding their business as well as those who are transforming from micro to small and medium enterprise owners, who are facing lack of capital goods/machines and have sourced from university graduate, industry and investment offices, Job Creation and Skill Development offices of the region and others directed by own hunters.

- The main long- and short- term goals of the company

Leasing help existing companies to expand their operations. Therefore, the MSMEs sector is one of the potentials the lease company shall give due emphasis in order to achieve its goal. To do so, Waliya capital Goods Finance Business Share Company shall propose unique value proposition that can meet its demand and attract this huge potential, which could potentially, provides future opportunity for the lease company as they grow to large enterprise. WCGFB S.C shall focus on MSMEs lease finance operations of selected sectors mainly manufacturing, Tourism, construction and other service and Agriculture sectors with lease finance of installment. Making fast the lease application speed, enhancing professionalism and financial knowhow of staff as well as meeting customers need is another MSMEs strategy of the on a continuous basis.

From a short run perspective, WCGFBSC should improve its branch and satellite presence to increase geographic coverage. Awareness creation and to presence good attitude about lease finance using social media like website, Facebook, telegram to reach its customers, and offer online customer service facilities (e.g: lease applications, uploading of KYC and other documents, making lease payments, and many others).

In the long run, the company intended to satisfy leasing market in the region and expand its service to country level to scale up the manufacturing and industry sector throughout the country and become a leading leasing company in Ethiopia .

Main Strategic Issues

The following are identified strategic issues of WCGFB S.C addressed in the strategic plan

- Business Promotion and Market expansion (Establish and develop strong partnership and networking with strategic client(s));

- Resource mobilization (Create and use innovative business models that Enhances company’s service Diversification);

- Customer service Excellency (Develop strategic capability of for providing best value to clients);

- Organization and people;

- Management information system/automation and digitalization;

- Financial Management (Generate reasonable return to the shareholders’ Investment);

- Risk management and compliance;

- product diversifications;

Goals

- Increasing destinations where services are provided and expand its customer outreach (customer Perspective);

- Mobilize resource and Improve Profitability (Financial Perspective);

- Increase capital goods supply (Internal Business Process Perspective);

- Achieve operational excellence (Learning and Growth Perspective);

No new vacancy for now

Contact us

Head Office

Tel.+251 58 220 6780/ 58 220 6786

Fax: +25158 220 5342 / 0583209918

Email:waliyacapital@gmail.com

Branchs' address

Addis Ababa Branch +251 11 170 6079

Bahir Dar Branch +251 58 222 1443

Tana Branch +251 58 220 8444

Gondar Branch +251 58 211 5023

Debre Markos Branch +251 58 178 0135

Dessie Branch +251 33 312 3600

Debre Birhan Branch +251 11 637 5084

Enjbara Branch +251 58 227 1627

Adiet Branch +251 58 338 1106

Kobo Branch +251 33 334 1141

Debark Branch +251 58 117 0554

Kombolcha Branch +251 33 851 4165

Woldya Branch +251 33 331 2585

Finote Selam Branch +251 58 775 0117

Debre Tabor Branch +251 58 141 0320

Sekotta Branch +251 33 540 0555

Kemissie Branch +251 33 554 1221

Worreta Branch +251 58 446 1341

M/Eyesus Branch +251 58 447 0219

Chagni Branch +251 58 225 0583

Burie Branch +251 58 774 1015

Bichena Branch +251 58 665 1621

G/Wuha Branch +251 58 331 0699

Gashena Branch +251 33 443 0734

S/Robit Branch +251 33 664 1936

Akesta Branch +251 33 814 1937

M/Meda Branch +251 11 685 0733

These are frequently asked questions (FAQ)

What are Eligibilities and Criteria to get your Services?

Where are your offices and thier address?

What are the company's services and products?

How can I get machinery Suppliers & know the cost?

Can you solve the infrastructure (working place and electricity) problem?

These are Answers for frequently asked questions (FAQ)

Eligibilities and Criteria to get our Services

Fully aware of the lease services of the leasing company/well know the service rendered by the company;

Sufficient knowledge, skill and understanding of the machinery /equipment/ required by the MSMEs;

The amount of lease capital /the total value of the asset/ required to be leased from Birr 25,000 to 10 million;

Can provide/submit/ a Business Plan or Can submit a Project Proposal for projects worth over 5 million Birr;

Ability to save up to 20 to 50 percent of the total value of the leased asset of the MSMEs ;

Provide detail specifications for the machine to be purchased:

The infrastructure is complete with adequate production and sales space;

The MSMEs have to be submitted a renewed business license, registration certificate and TIN;

Audited accounts of existing enterprises; otherwise are new, willing to investigate;

Have a good credit history from other lending financial institutions;

Those who have operating funds or can get a loan from the Financial institutions;

Those who are willing to cover for travel and fire insurance and are willing to renew their machines/equipment/ agreement annually;

Those who are willing to register the contracts and also the machines/equipment;

Willing to maintain the leased asset /machine/ properly and repairs the machine/asset/ in the event of a breakdown;

Provide evidence of marital status (married / unmarried)

Provide renewed residency ID from kebeles (sub-cities);

The MSMEs, who are interested in engaging in priority activities (sectors)

Our offices and thier address

Head Office

Tel.+251 58 220 6780/ 58 220 6786

Fax: +25158 220 5342 / 0583209918

Email:waliyacapital@gmail.com

Branchs’ Address

Addis Ababa Branch +251 11 170 6079

Bahir Dar Branch +251 58 222 1443

Tana Branch +251 58 220 8444

Gondar Branch +251 58 211 5023

Debre Markos Branch +251 58 178 0135

Dessie Branch +251 33 312 3600

Debre Birhan Branch +251 11 637 5084

Enjbara Branch +251 58 227 1627

Adiet Branch +251 58 338 1106

Kobo Branch +251 33 334 1141

Debark Branch +251 58 117 0554

Kombolcha Branch +251 33 851 4165

Woldya Branch +251 33 331 2585

Finote Selam Branch +251 58 775 0117

Debre Tabor Branch +251 58 141 0320

Sekotta Branch +251 33 540 0555

Kemissie Branch +251 33 554 1221

Worreta Branch +251 58 446 1341

M/Eyesus Branch +251 58 447 0219

Chagni Branch +251 58 225 0583

Burie Branch +251 58 774 1015

Bichena Branch +251 58 665 1621

G/Wuha Branch +251 58 331 0699

Gashena Branch +251 33 443 0734

S/Robit Branch +251 33 664 1936

Akesta Branch +251 33 814 1937

M/Meda Branch +251 11 685 0733

Our products and services

Hire purchase

Financial lease

Training

Consultancy

Regarding machinery costs and Suppliers

We are to finance to the requested machineries. So, the due costumers must have sufficient understanding and Knowledge on the business area and the needed machineries including their cost and suppliers.

Regarding infrastructure (working place and electricity)

As briefly stated on Eligibilities and Criteria to be fulfill, we are serving only enterprises who get ready fully infrastructure Working place. So, passable production and sales space issues may head for the government bodies.

Eligibilities and Requirements to get our services

Requirements or eligible criteria to get a lease Finance from our company are:-

- Fully aware of the lease services of the leasing company/well know the service rendered by the company;

- Sufficient knowledge, skill and understanding of the machinery /equipment/ required by the MSMEs;

- The amount of lease capital /the total value of the asset/ required to be leased from Birr 25,000 to 10 million;

- Can provide/submit/ a Business Plan or Can submit a Project Proposal for projects worth over 5 million Birr;

- Ability to save up to 20 to 50 percent of the total value of the leased asset of the MSMEs ;

- Provide detail specifications for the machine to be purchased:

- The infrastructure is complete with adequate production and sales space;

- The MSMEs have to be submitted a renewed business license, registration certificate and Taxpayer Identification Number (TIN);

- Audited accounts of existing enterprises; otherwise are new, willing to investigate;

- Have a good credit history from other lending financial institutions;

- Those who have operating funds or can get a loan from the Financial institutions;

- Those who are willing to cover for travel and fire insurance and are willing to renew their machines/equipment/ agreement annually;

- Those who are willing to register the contracts and also the machines/equipment;

- Willing to maintain the leased asset /machine/ properly and repairs the machine/asset/ in the event of a breakdown;

- Provide evidence of marital status (married / unmarried)

- Provide renewed residency ID from kebeles (sub-cities);

- The MSMEs, who are interested in engaging in priority activities (sectors)

Stakeholders

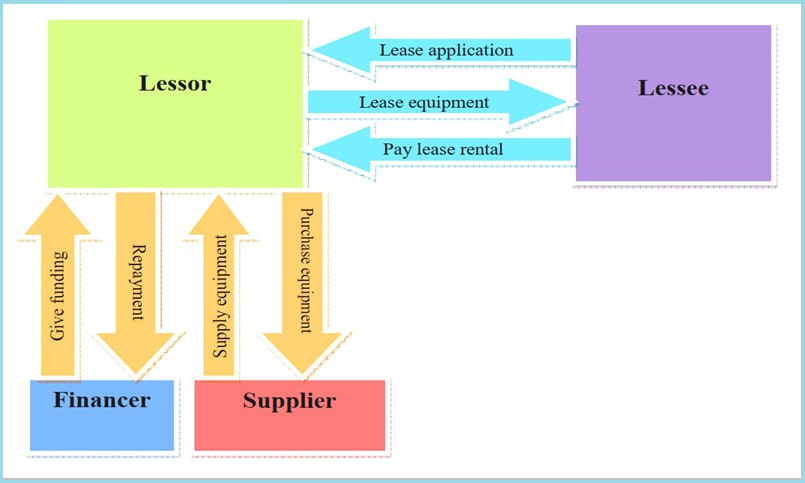

WCGFB S.C has been undertaking three fundamental functions namely Resource mobilization, equipment purchase, and equipment lease engagement. The value propositions of stakeholders in terms of three major functions of the company have been identified and their association with the activities of the Company.

- Company Board/ shareholders

- Company Management

- Staffs

Internal

- NBE

- Customer/Lessee

- Supplier/manufacturer

- Financer/Donors

- Federal,Regional & local gov't admins.

- Labour and training offices

- Tseady Bank s.c

- Industry and Investment offices

- Trade and Market Development offices

- Women, Children & Social Affairs offices

- Youth and Sport offices

External

Based on the stakeholder analysis the main parties in lease financing service are financer, lessee, lessor and supplier. The picture shows the relationship of those parties:

.png)